Back

28 Feb 2023

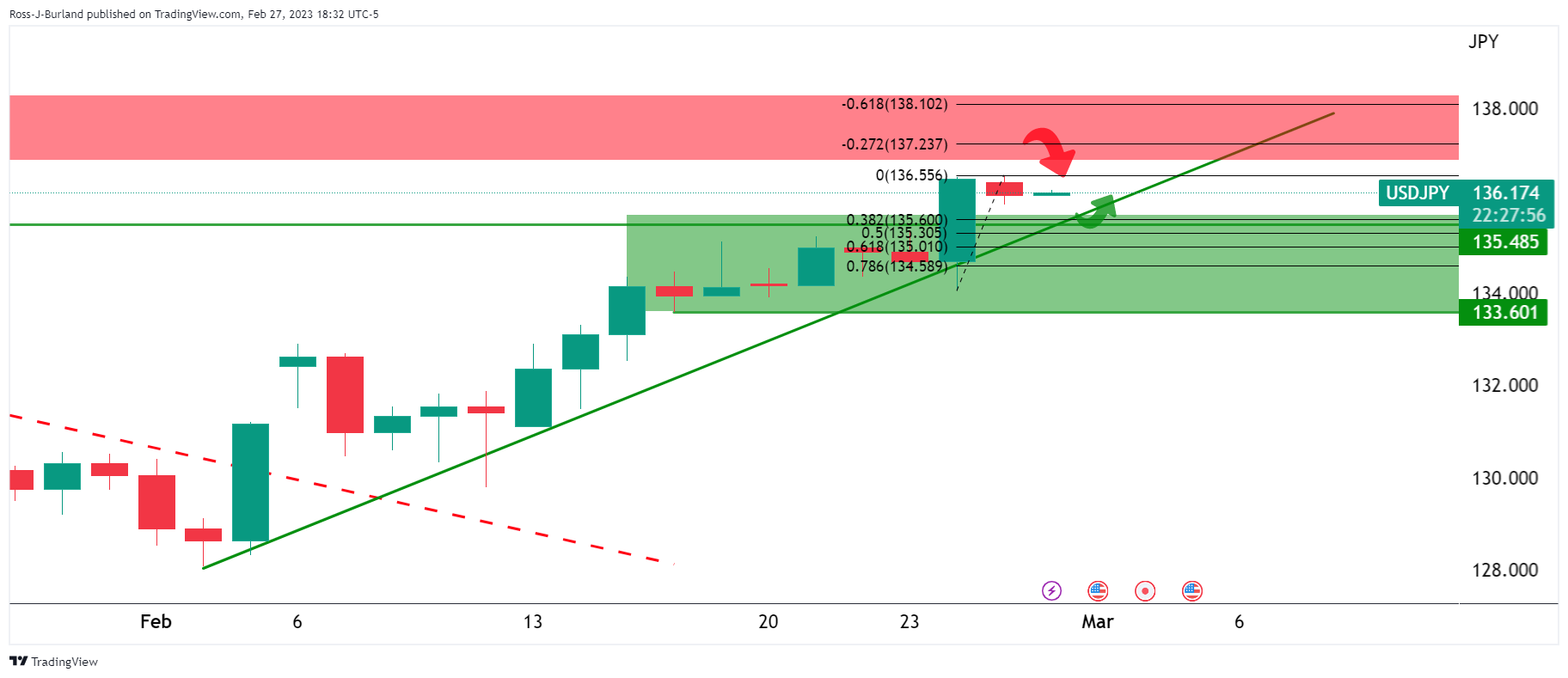

USD/JPY Price Analysis: Bears seek a break in trendline support

- USD/JPY is at risk of a long squeeze for the days ahead.

- If the bears get below 135.50 and then 134, 132.50 will be eyed.

The US Dollar fell from a seven-week high on Monday, tracking a slide in US Treasury yields which has lifted the Yen into test support structure in USD/JPY. A higher-than-expected drop in US Durable Goods of 4.5% last month, reversing a huge December boost from Boeing as snapped a streak of inflationary data out of the region, bringing some long-needed relief for the risk and currencies vs. the US Dollar.

The following illustrates a bullish bias while the price remains on the front side of the bullish trend

USD/JPY daily charts

The price can remain in the hands of the bulls but there are risks of a long squeeze for the days ahead. If the bears get below 135.50 and then 134, 132.50 will be eyed: