NZD/USD bears are moving in to test H1 structure

- Volatility remains elevated in financial markets.

- NZD/USD bears are in the market and testing structure.

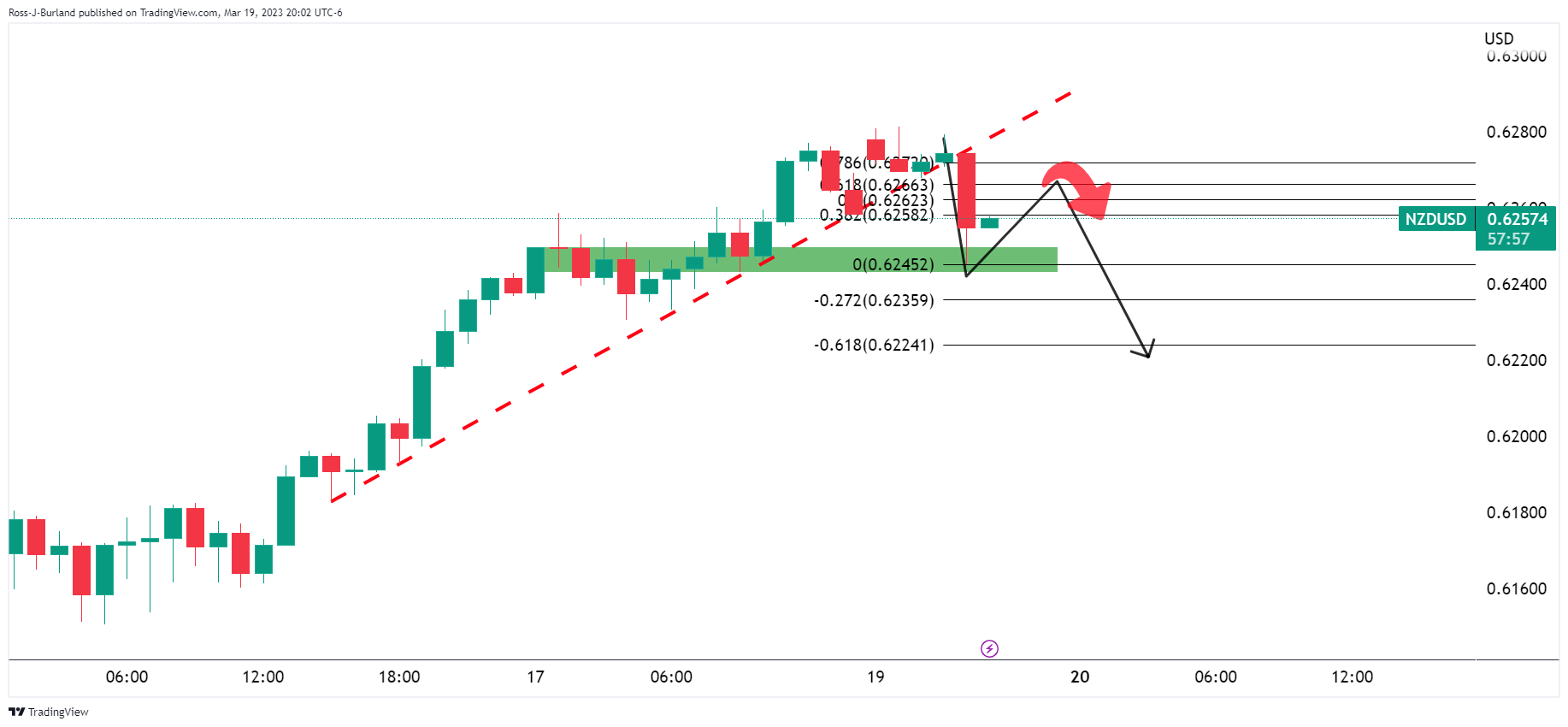

NZD/USD is meeting a prior area of support on the hourly charts as the bears move in from the session´s highs near 0.6280. NZD/USD has traveled between there and 0.6245 so far.

Volatility remains elevated and there is news from the weekend that UBS is said to take over Credit Suisse in a deal aimed at stemming what was fast becoming a global crisis of confidence. Credit Suisse, the 167-year-old embattled lender had been brought to the brink of financial calamity last week, despite securing a $54bn (£44bn) credit line from Switzerland's central bank.

´´Financial instability and bank wobbles remain the focus, and it’s hard to see that going away any time soon, so expect ongoing volatility,´´ analysts at ANZ Bank said.´´On the one hand, New Zealand seems remote from all this (that’s a positive) and the issue of getting inflation back to target is just as (if not more) pressing here than elsewhere. But equally, markets remain fearful of NZ’s wide current account deficit and other imbalances, and of what impact a likely Fed hike this week may bring (likely a stronger USD if the Fed contains contagion fears while hiking).´´

NZD/USD technical analysis

NZD/USD is on the backside of the trend which leaves a bearish bias for the week ahead while below 0.6280.