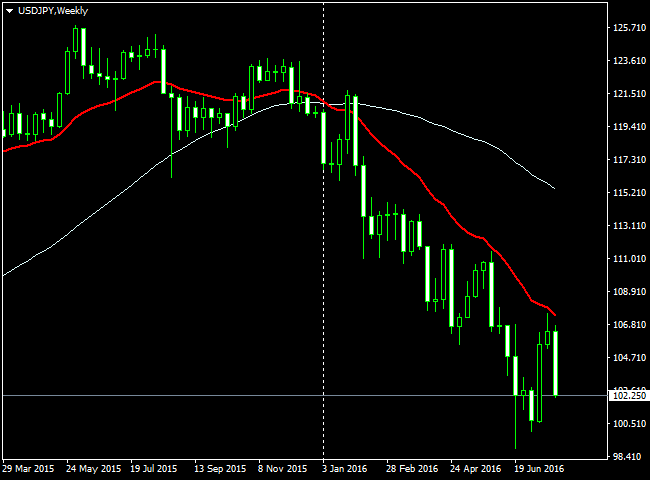

USD/JPY keeps falling toward 102.00

USD/JPY dropped further and bottomed at 102.12, hitting the lowest level since July 11. The pair has now fallen more than 300 pips on Friday. The area above 102.00 so far capped the decline but the US dollar remains under pressure across the board.

The yen remains strong in the market, near daily highs and despite the recovery of equity prices in Wall Street. Bond yields are falling favoring the demand for the Japanese currency. Treasuries started to rally after the release of the US GDP report, that come below expectations.

First the FED, the BoJ and then US GDP

USD/JPY started to decline on Friday during the Asian session after the Bank of Japan announced an expansion of its ETF purchase program. The decline after BoJ decision added to weekly gains.

During the week it moved with a downside bias. It rose only on Wednesday before the Federal Reserve statement, amid rumors regarding what Japanese officials could announce soon. After the FOMC decision it dropped back below 105.00 and today it lost 104.00 and 103.00.

From the level it had a week ago, the pair is 400 pips lower and now it could post the second lowest weekly close of the year.