US dollar index ends week lower, retreating modestly from 13-year highs

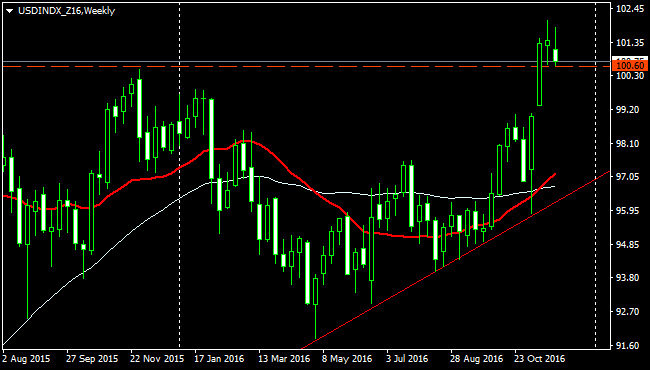

The US dollar index ended the week with modest losses (-0.70%) and remains above the key short-term support located around the 100.60 zone. It is the first decline since the US presidential elections and represents a retreat after reaching back on November 24, the strongest level in 13 years at 102.05.

The DXY finished with modest losses on Friday, after the November US employment report showed a gain in payrolls by 178k and a decline in the unemployment rate to 4.6%. On the negative side, earnings growth remained tepid.

Data supports FOMC move and USD

The latest US economic data, contributed to keep Fed rate hike expectations anchored. Market consensus point toward a rate hike and analysts start to look into what could happen during 2017 with the Fed Funds rate.

“Dollar strength is expected to be sustained as U.S. interest rates are forecast to rise slightly faster that currently priced into the futures curve and certainly at a faster pace compared to other major economies (Japan, Euro). Moderate U.S. dollar long positions indicate that there is still scope for further dollar gains”, said analysts at Wells Fargo.

The bearish correction of the US dollar index, that jumped 4% after Trump’s election, was limited so far. Greenback received support from US bond yields. Despite the recovery in Treasury bonds on Friday, yields finished the week higher.