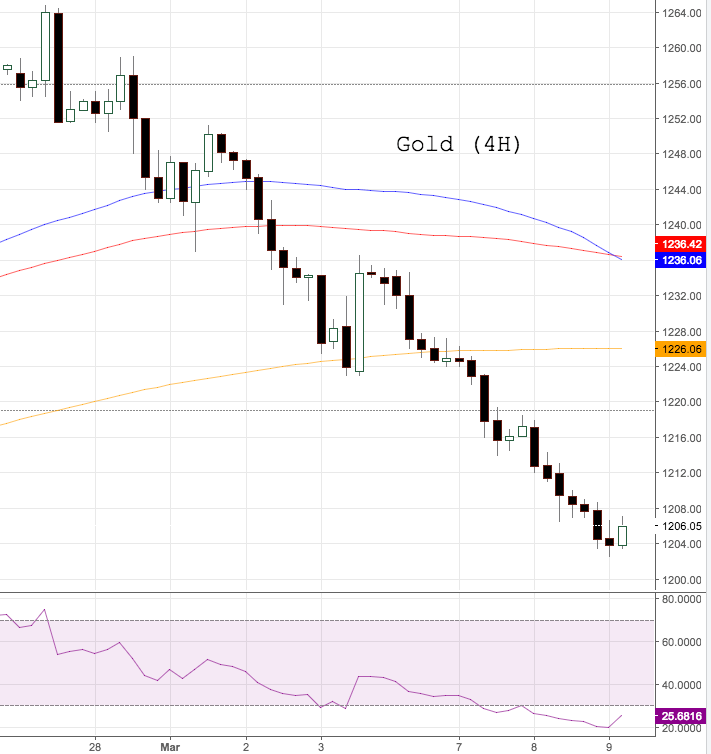

Gold sinks to lows, challenges $1,200

The selling pressure around the yellow metal has gathered extra steam on Thursday, with the troy ounce now looking to challenge the critical support around the $1,200 mark.

Gold lower on rate hike bets

Bullion is prolonging its decline for the eighth consecutive session so far, navigating in fresh 5-week lows amidst rising speculations of a Fed move at its meeting next week.

In fact, Reuters’s Fedwatch is now placing the probability of a 25 rate hike on March 15 at almost 90%, heavily weighing on the demand for the safe haven metal, lifting yields in the US money markets and pushing the US Dollar Index (DXY) to challenge recent multi-week highs in the 102.30 region.

In the meantime, the yellow metal continues to fade the recent spike to fresh 3-month highs just above $1,260 seen in late February, putting the 100-day sma to the test and potentially opening the door for further weakness towards the $1,193 level, 50% Fibo of the December-February up move.

Gold key levels

As of writing Gold is losing 0.24% at $1,206.50 and a breakdown of $1,193.50 (50% Fibo of the December-February up move) would expose $1,185.60 (low Jan.26) and finally $1,177.07 (61.8% Fibo of the December-February up move). On the upside, the next hurdle aligns at $1,212.20 (high Mar.8) seconded by $1,225.40 (high Mar.7) and then $1,230.25 (23.6% Fibo of the December-February up move).