Back

11 Jul 2018

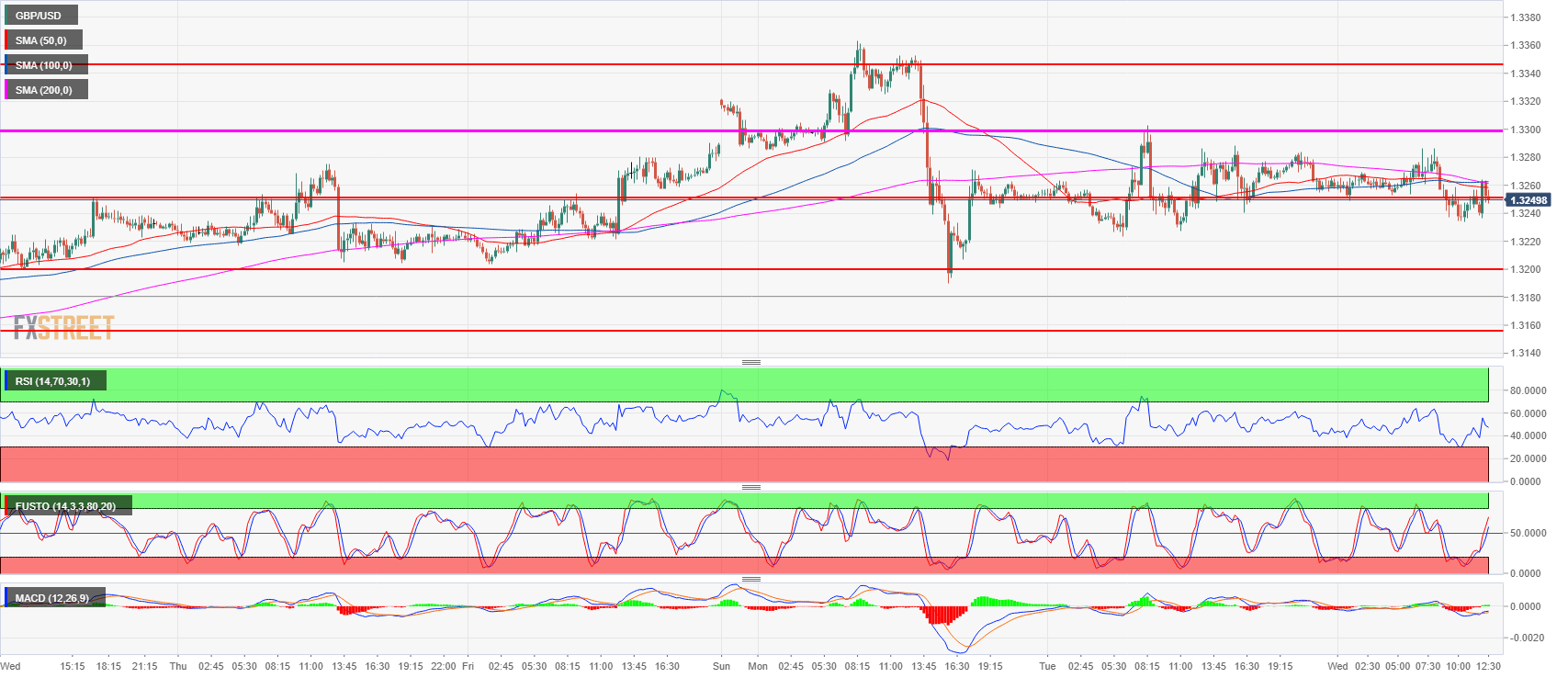

GBP/USD Technical Analysis: Sub-1.3300 Cable on the verge of a breakout

- GBP/USD is trading inside its the previous day’range for the second consecutive day suggesting that the market is on the verge of a breakout.

- In the broader context, GBP/USD is in a bear trend and has rejected the daily 50-period simple moving average on Monday with a strong 170-pip sell-off, suggesting that the odds are slightly tilted to the downside for the time being.

- Mark Carney, the Bank of England Governor is set to speak about the global financial crisis at the National Bureau of Economic Research conference in Boston at 15:35 GMT.

GBP/USD 15-minute chart

Spot rate: 1.3250

Relative change: -0.13%

High: 1.3286

Low: 1.3233

Trend: Neutral to bearish

Resistance 1: 1.3300 figure

Resistance 2: 1.3363 weekly high

Resistance 3: 1.3400 figure

Resistance 4: 1.3472 June’s high

Support 1: 1.3250 June 4 high

Support 2: 1.3200 figure

Support 3: 1.3155 former breakout point

Support 4: 1.3100 figure

Support 5: 1.3049 current 2018 low

Support 6: 1.3027 October 6, 2017 swing low