Back

12 Oct 2018

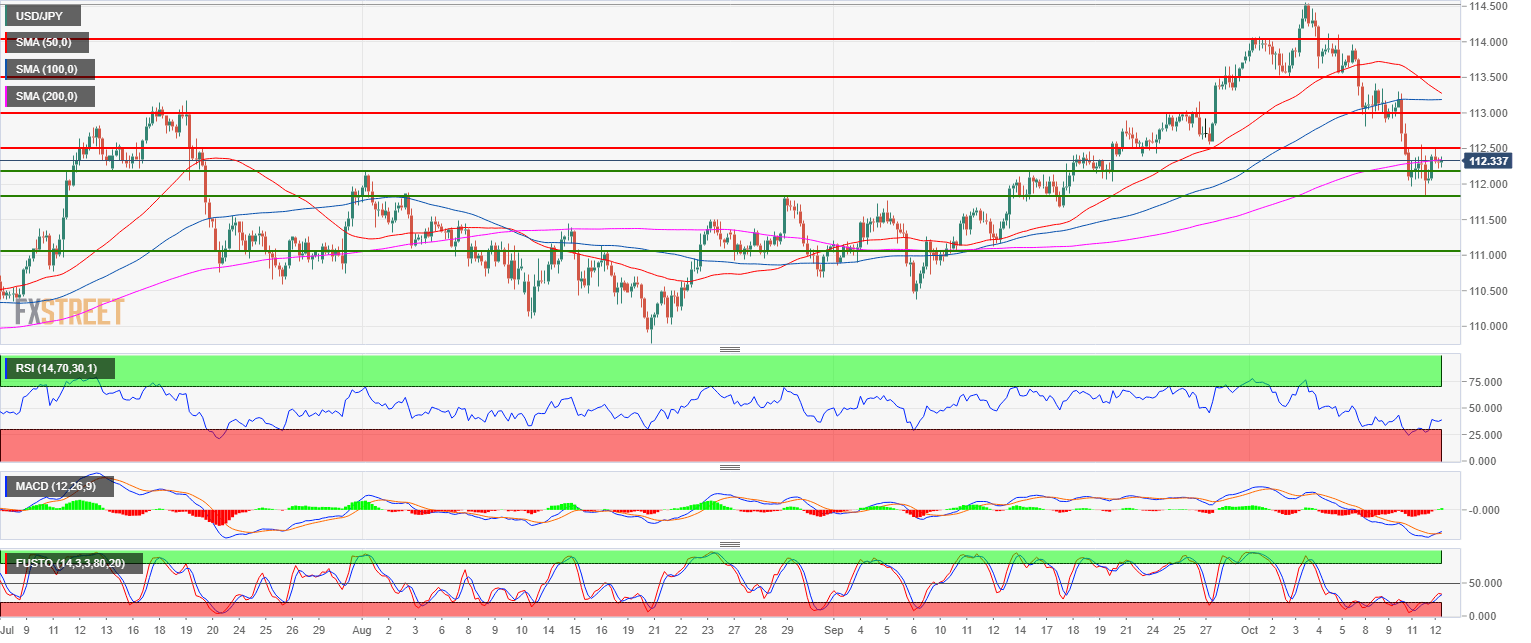

USD/JPY Technical Analysis: The bearish pullback might have run its course as Greenback bulls are holding the market above 112.00 figure

- USD/JPY is in a bullish trend and had a pullback down to the 200-period simple moving average on the 4-hour chart and the 50-day simple moving average (not shown).

- USD/JPY is currently trying to stabilize above the 112.00 level as bulls might potentially launch a new bull run from there. The RSI is still below 50 suggesting weak bullish momentum while the MACD and Stochastic are slowly rising which is encouraging for bulls. Resistances to the upside can be located near 112.55 (September 27 low) and 113.00.

- However, a strong bear breakout below 111.84 (August 29 swing high) on a daily closing basis would likely invalidate the bullish bias.

USD/JPY 4-hour chart

Spot rate: 112.31

Relative change: -0.32%

High: 112.51

Low: 112.00

Main trend: Bullish

Resistance 1: 112.55 September 27 low

Resistance 2: 113.00 figure

Resistance 3: 113.55 October 2 low

Resistance 4: 113.55 October 2 low

Resistance 5: 114.00 figure

Resistance 6: 114.80 November 2017 high

Resistance 7: 115.50 March 10, 2017 high

Support 1: 112.00-112.17 zone, figure and August 1 swing high

Support 2: 111.84 August 29 swing high

Support 3: 111.00 figure