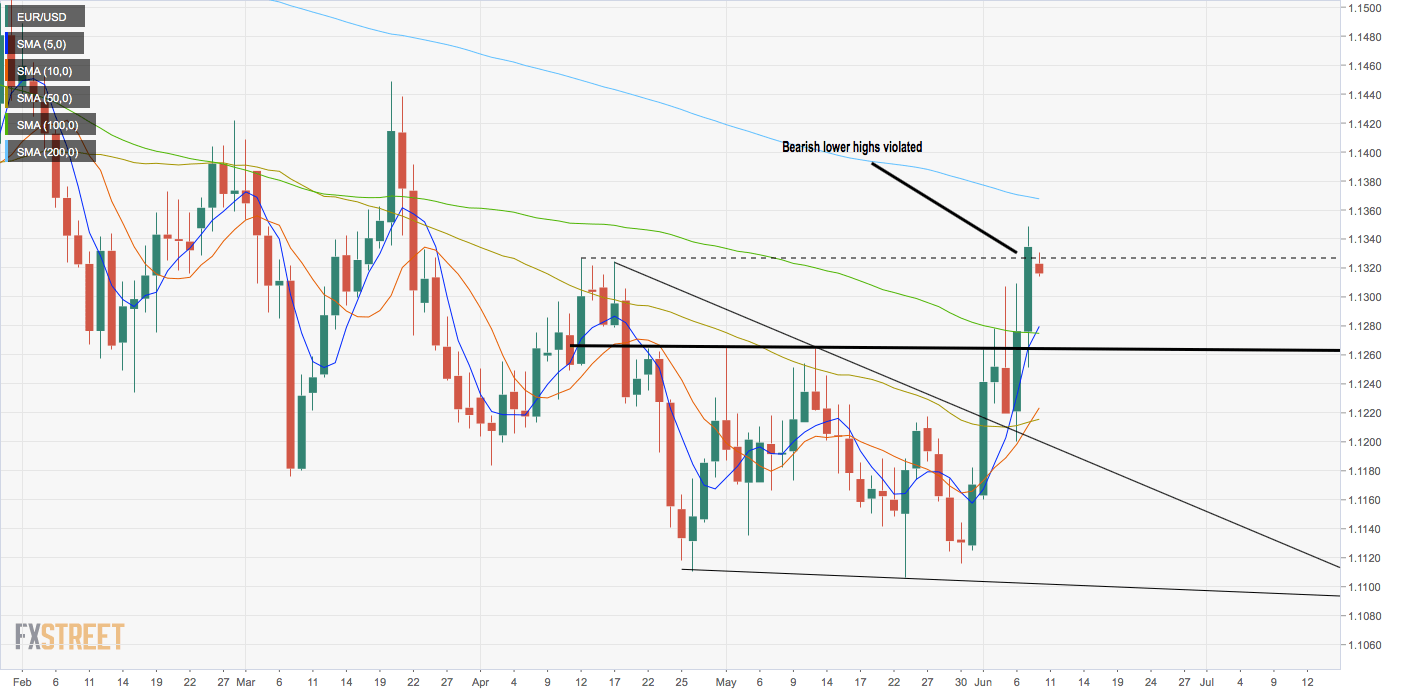

EUR/USD technical analysis: Bearish lower highs invalidated, eyes 200-day MA

- EUR/USD has violated the bearish lower highs pattern.

- The MA studies on the daily chart are biased bullish.

- Friday’s close also validated Thursday’s bullish outside reversal candle.

EUR/USD closed above 1.1324 (April 15 high) on Friday, invalidating the bearish lower highs pattern, which had been in place since Jan. 10.

Friday’s close at 1.1332 also marked a strong follow-through to the bullish outside day candle created at on the previous day.

The daily chart also shows a double bottom breakout and descending triangle breakout.

Further, the 5- and 10-day moving averages (MAs) are trending north, indicating a bullish setup. Also, the 5- and 100-day MAs and the 10- and 50-day MA have produced a bullish crossover.

With the short-term technical profile looking bullish, the pair looks set to test the 20o-day MA hurdle this week. As of writing, the crucial average is located at 1.1367. The pair is currently trading at 1.1318, having hit a high of 1.1331.

Daily chart

Trend: Bullish

Pivot levels