Back

12 Oct 2019

EUR/USD technical analysis: Euro ends the week in the green above the 1.1000 handle

- EUR/USD is ending the week in positive territories adding 0.70%.

- The risk-on market mood and the Brexit optimism turned in favor of the EUR/USD bulls.

- The Michigan Consumer Sentiment Index came in better-than-expected at 96 vs 92 in October.

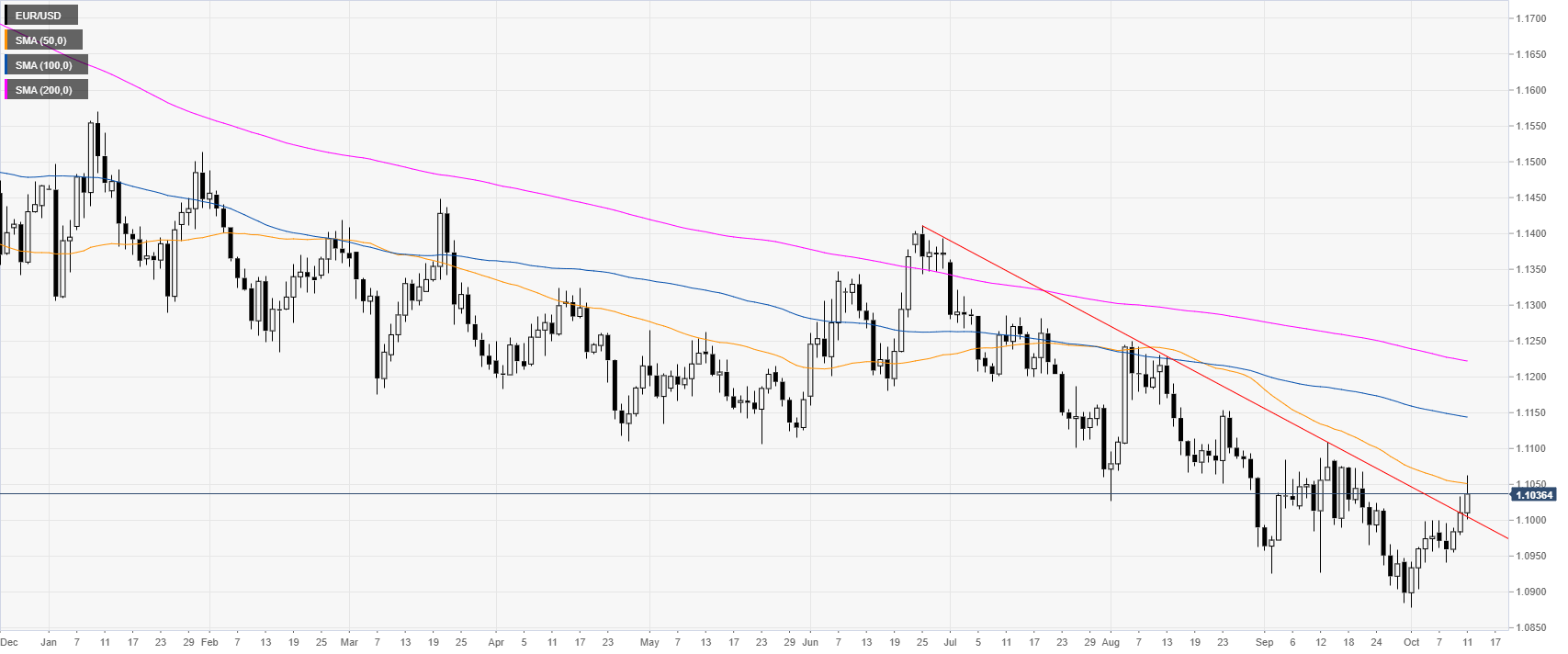

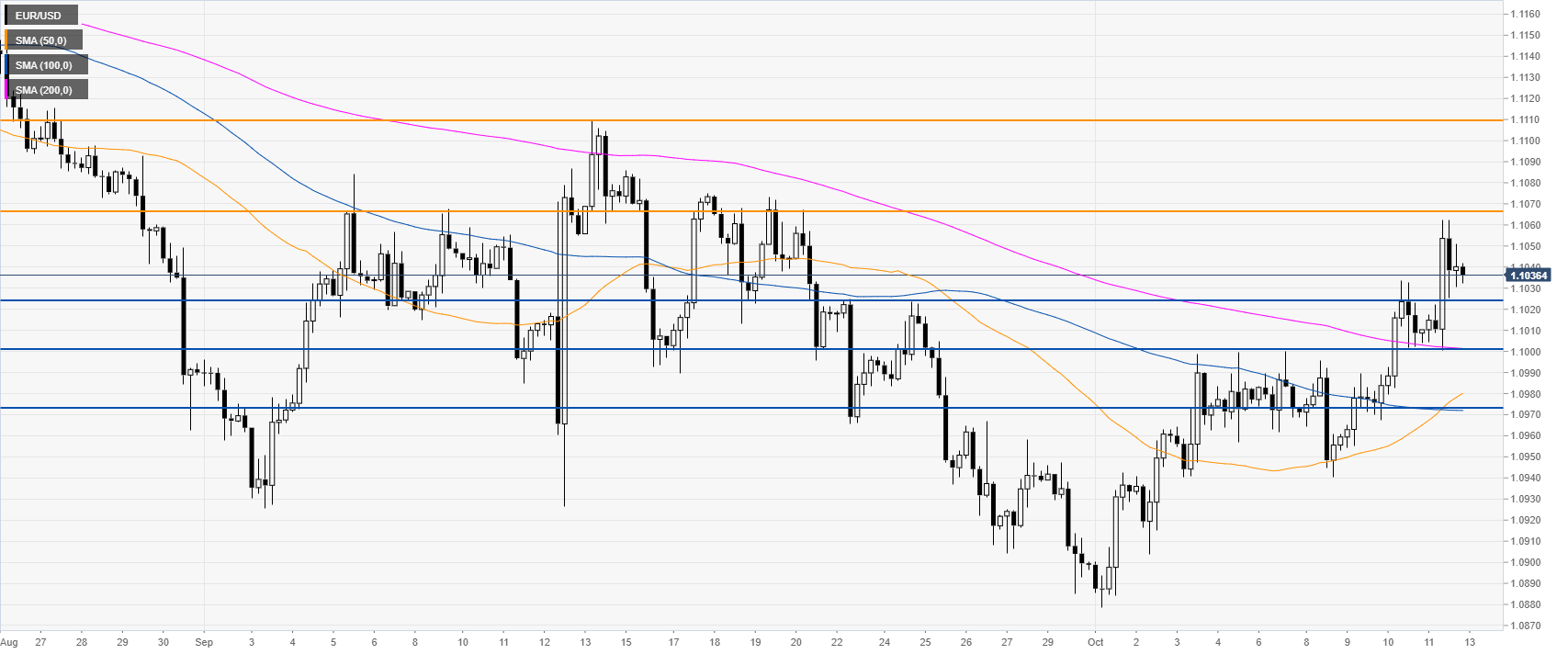

EUR/USD daily chart

On the daily chart, the shared currency is trading in a bear trend below the 100 and 200-day simple moving averages (DSMAs). The Fiber is breaking above a multi-week trendline and is challenging the 50 SMA. This Friday, the Michigan Consumer Sentiment Index came out better-than-expected at 96 vs 92 for October. The news limited further gains in the New York session.

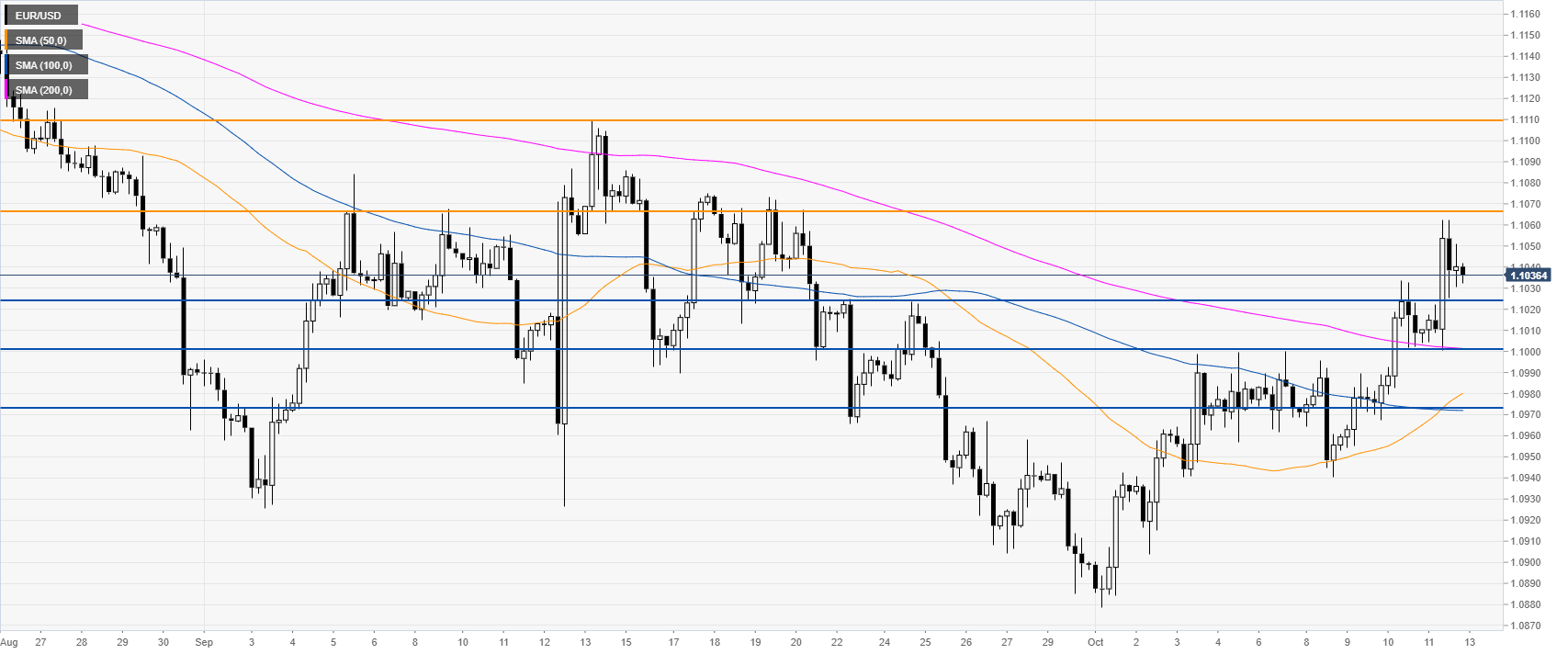

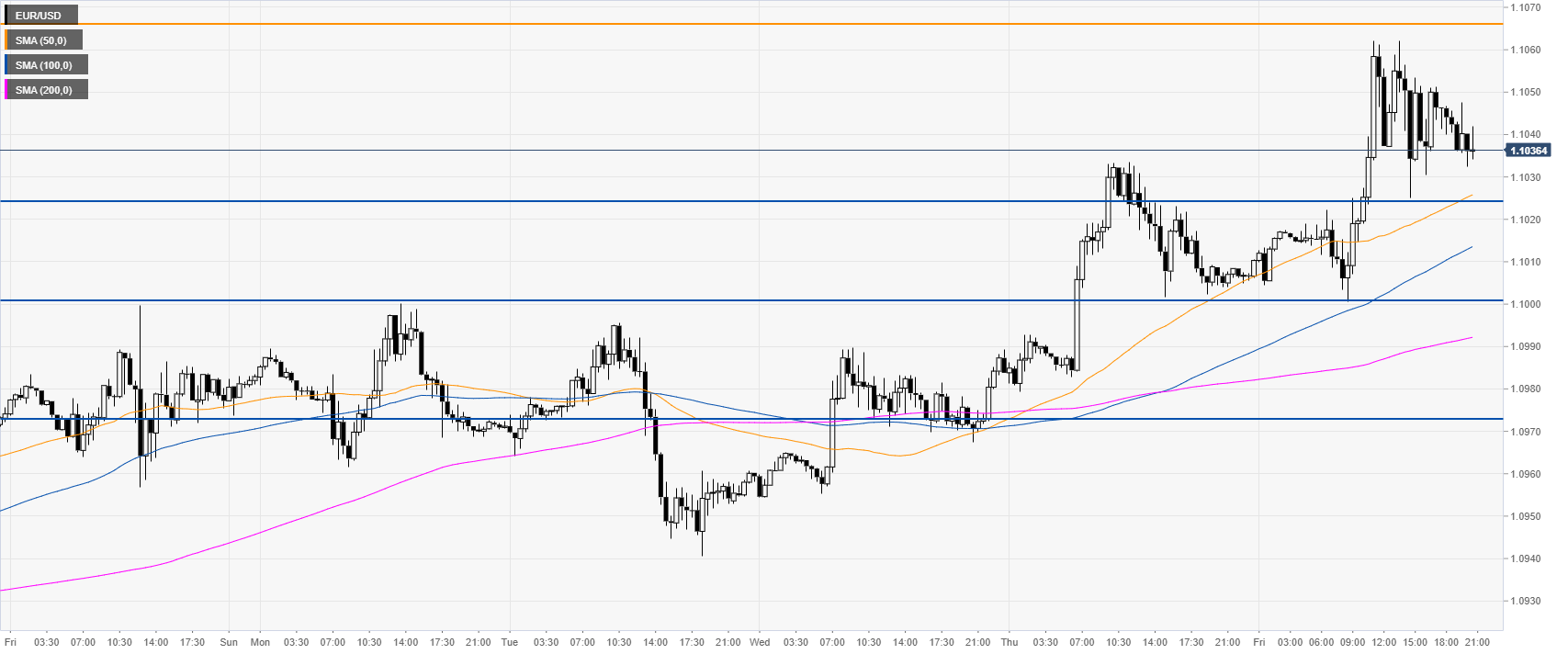

EUR/USD four-hour chart

The spot is trading above the main SMAs, suggesting bullish momentum in the medium term. EUR/USD is consolidating the weekly gains below the 1.1065 resistance as bulls remain in control. A break above 1.1065 can expose the 1.1110 resistance, according to the Technical Confluences Indicator.

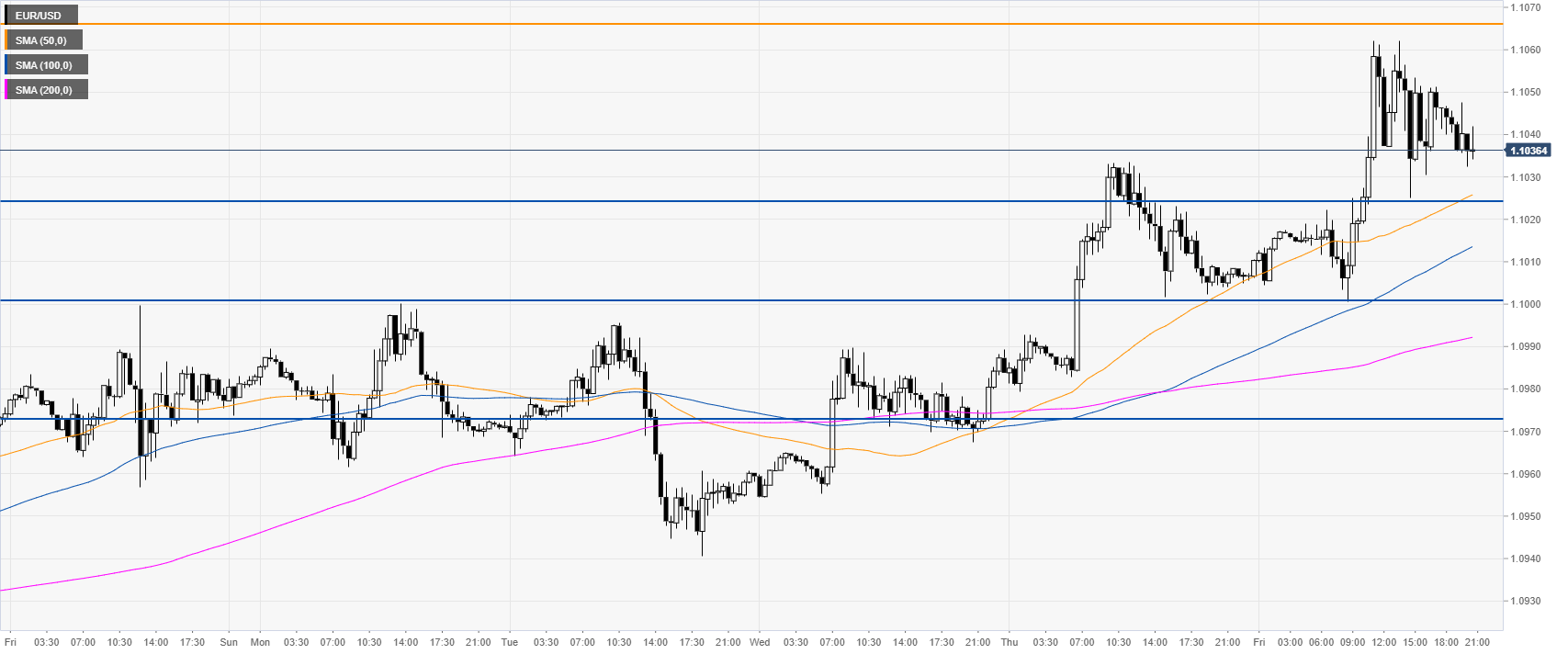

EUR/USD 30-minute chart

The Euro is trading above the main SMAs, suggesting bullish momentum in the near term. Support is seen at the 1.1025/07 zone and the 1.0972 price level.

Additional key levels