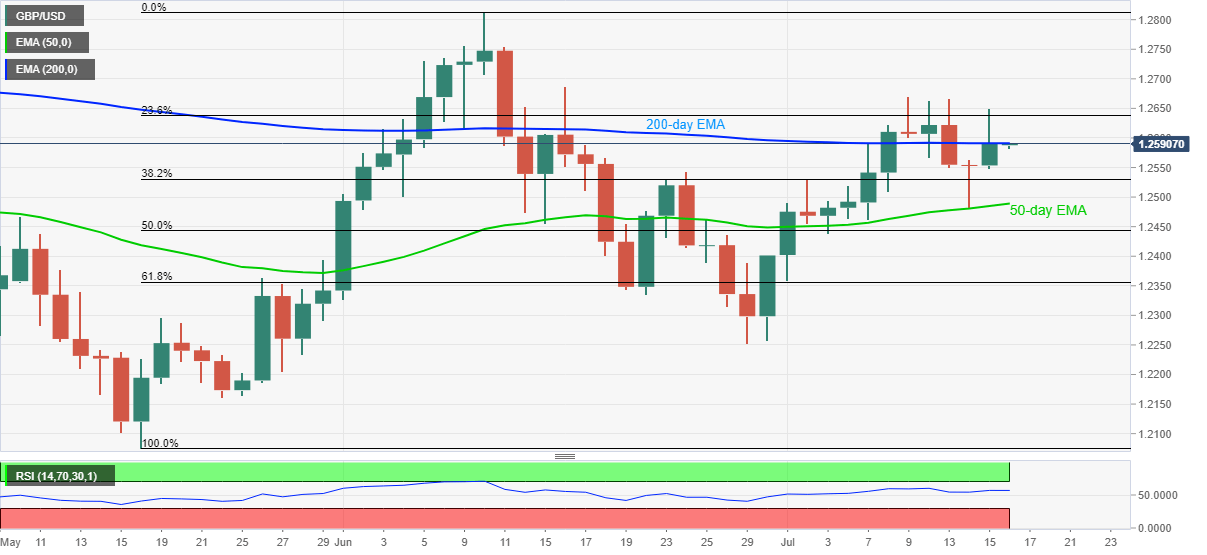

GBP/USD Price Analysis: Clings to 200-day EMA in search of further upside

- GBP/USD portrays a lack of momentum near 1.2600 threshold.

- A sustained bounce off 50-day EMA, normal RSI favor the bulls.

- Bears could seek entries below June 24 top.

GBP/USD seesaws around 1.2580/92, currently near 1.2589, amid the initial Asian session on Thursday. In doing so, the Cable takes rounds to 200-day EMA after posting a positive daily close the previous day. Even so, the pair’s successful recovery from 50-day EMA suggests further upside amid upbeat RSI conditions.

Hence, bulls can keep the monthly high of 1.2670 on the cards with 1.2600 acting as immediate resistance.

However, the quote’s further upside needs validation from 1.2700 to attack the June month’s peak of 1.2813.

If sellers wish to enter, they should wait for a downside break below June 24 high of 1.2543. In doing so, the 50-day EMA level of 1.2489 can become an immediate target.

During the further downside past-1.2489, 50% and 61.8% Fibonacci retracements of the pair’s May-June upside, respectively near 1.2440 and 1.2355/50, could entertain the bears.

GBP/USD daily chart

Trend: Further recovery expected