AUD/USD Price Analysis: A fresh daily low could be on the cards

- AUD/USD bears move in on critical 4-hour support in a flash.

- This could be the makings of a fresh daily low, although the 4-hour support is a risk.

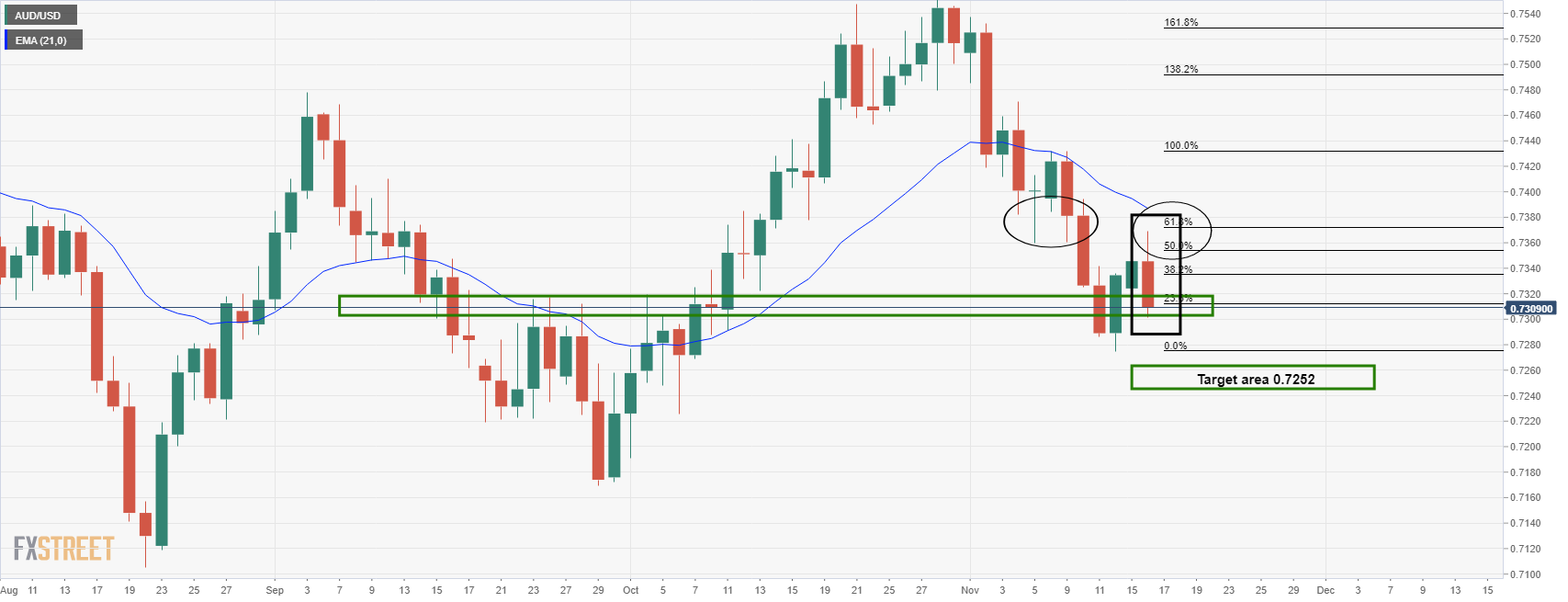

As per the prior analysis, AUD/USD Price Analysis: Bears to target 0.7220, bulls look for test of 0.7420, the bears have finally taken charge and with vigour. However, it could be too late to take advantage, at least from a swing trading perspective on the daily chart.

Nevertheless, the following is a breakdown of price action and where there still could be the possibility of an optimal entry on the 4-hour time frame.

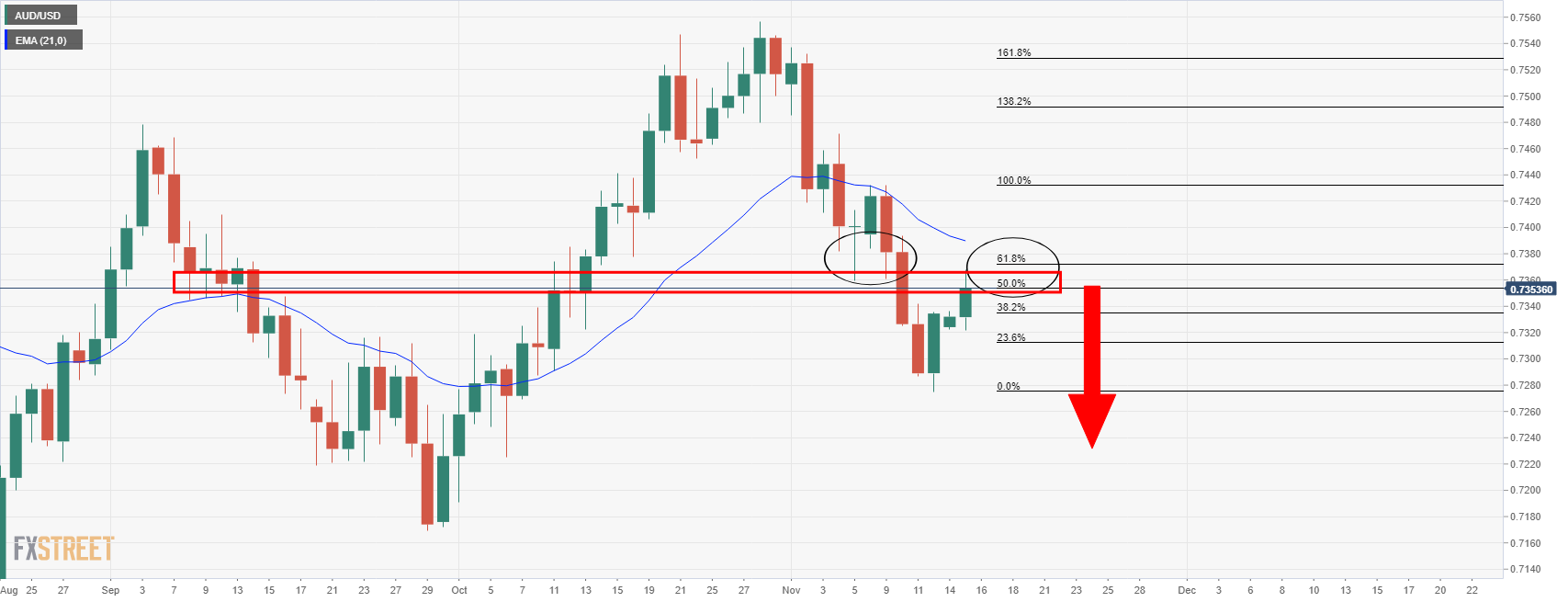

AUD/USD prior analysis

The above analysis was from the prior session and we have seen some superb bearish development as follows:

The price, as illustrated, has indeed fallen into the projected support area. However, it has done so in a sharp move which gives rise to the risk of a support structure forming which could be problematic from an entry perspective.

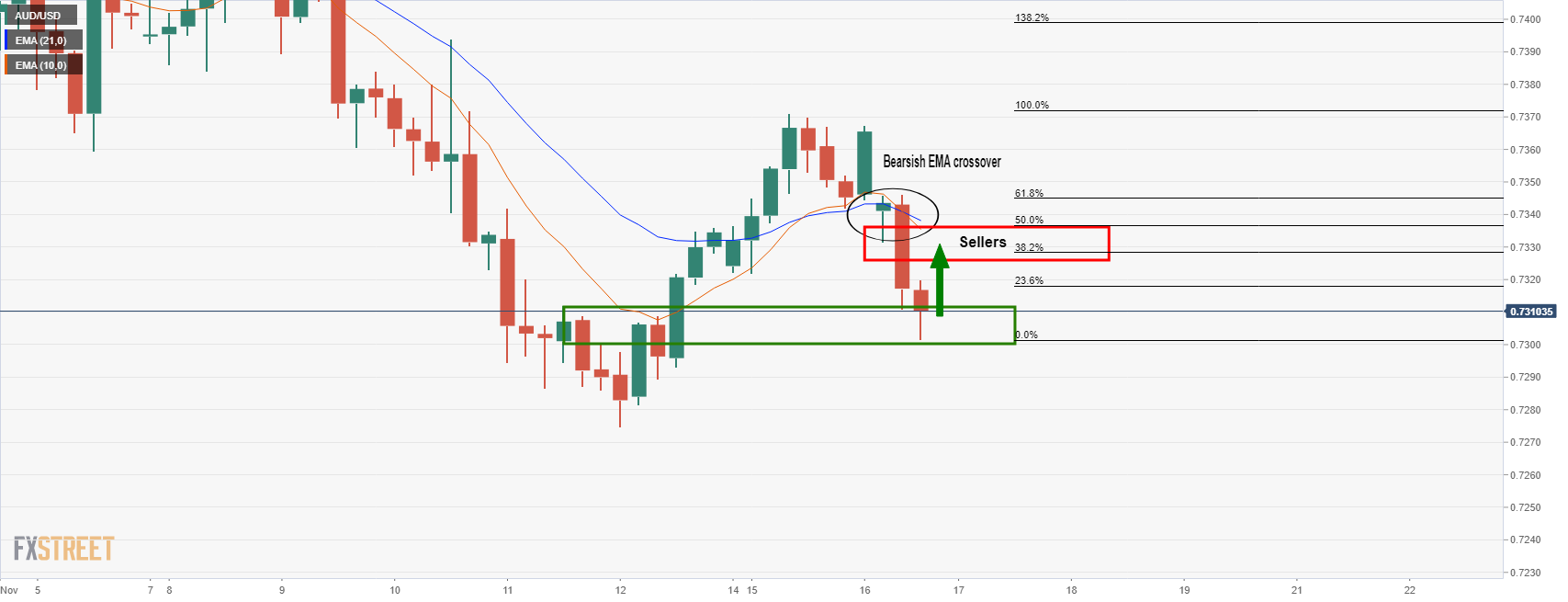

AUD/USD H4 chart

As per the prior analysis, it was stated that bears could be getting ''prepared for a downside continuation by monitoring for a bearish environment from the 4-hour chart as follows,'' ...

It was explained that the bears would be looking for the 21 and 10-EMAs to turn south and crossover to signal a bearish environment. ''A break of the 0.7320s will likely result in a downside continuation for a fresh daily low towards 0.7250 and then 0.7220.''

The price has followed suit as follows:

At this juncture, the bears could be seeking a discount near the EMA crossover and between the 38.2% and 50% ratios near 0.7330 that would be expected to act as resistance on a retest of the structure. This will enable bears that are late to the party to get on board what could turn out to be a continuation of the weekly bear trend.

With that being said, the M-formation is a reversion pattern that would be expected to pull the price in to test the neckline of the formation which has a confluence of the 61.8% Fibo near 0.7350. Considering that the price has already met support, there is the risk that the price basis there and potentially moves higher beyond the M-formation's structure towards 0.7380. Ideally, bears will have already engaged with this current impulse to the downside and have moved their stop loss to breakeven by now to protect against such a scenario.