AUD/USD Price Analysis: Bears move the Aussie to the edge of the abyss

- AUD/USD bears stay in control and now test deeper support.

- Geopolitics could tip AUD/USD over the edge into the abyss and towards the depths of the 0.70 area.

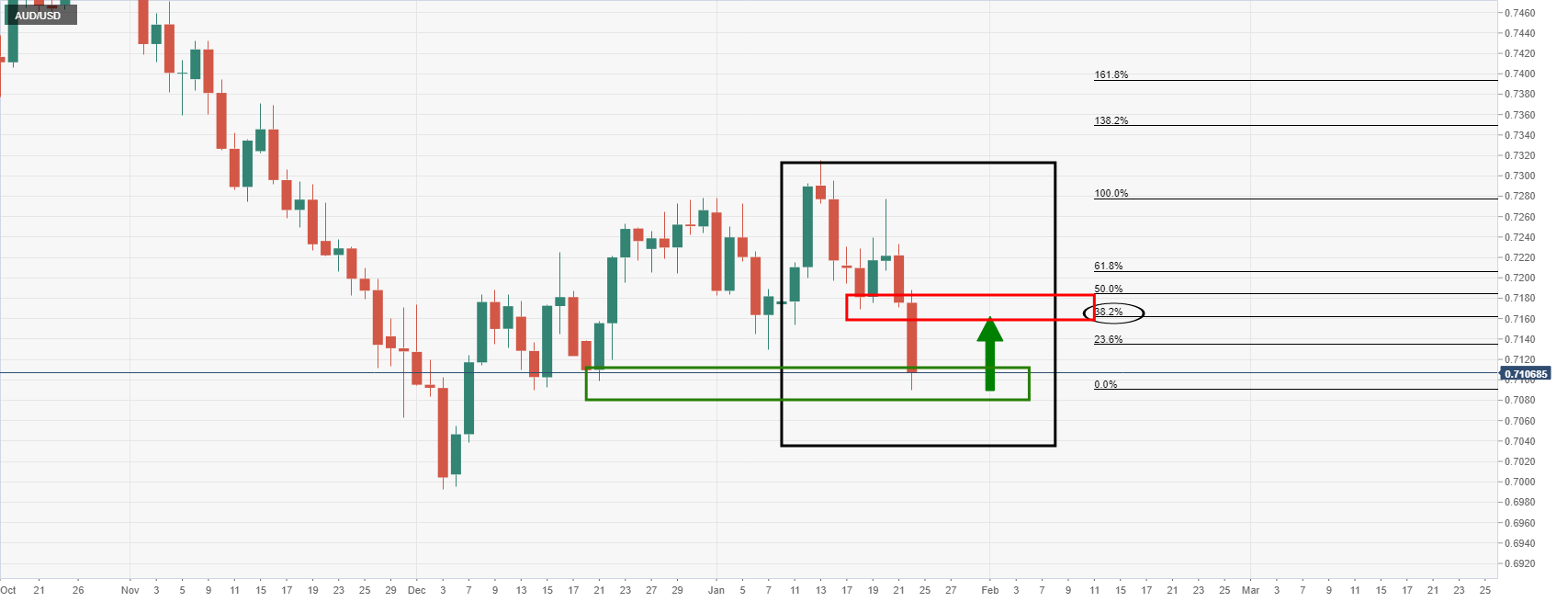

As per the pre-open analysis, AUD/USD Price Analysis: Bears are in control at critical support, the bears have been in control at the start of this week and snapped the critical support.

AUD/USD prior analysis

AUD/USD, live daily chart

The risk-off tone to markets at the start of this week has seen US stocks plummet and the high beta currencies, such as the Aussie taken along for the ride.

Relatively higher yields in the US and the anticipation of Fed rate hikes this year suggests that USD could continue to benefit in the face of possible conflict in central Asia.

DXY H1 chart

The US dollar, as measured by the DXY index, is stalling for now and looks to be homing in on the 50% retracement of the last bullish impulse. The 61.8% ratio meets with prior highs as a firmer layer of potential support for the sessions ahead.

Meanwhile, AUD/USD's M-formation on the daily chart is a compelling chart pattern for the week ahead. A reversion towards 0.7150/60 would be expected for the days ahead:

However, considering how fluid the geopolitics is, if there is a Russian invasion of Ukraine, the US dollar would be expected to continue higher. In turn, this would be taking the Aussie down with it for a test of bullish commitments in the lower end of the 0.70 areas.