EUR/USD pushes higher and flirts with 1.1200

- EUR/USD approaches the key barrier at 1.1200.

- German 10y Bund yields advance past 0.03%.

- EMU flash Q4 GDP rose 4.6% YoY, 0.3% QoQ.

The buying interest around the European currency keeps growing on Monday and pushes EUR/USD to the very boundaries of 1.1200 the figure.

EUR/USD bid on risk-on trade, data

EUR/USD posts gains for the second session in a row on Monday, bolstered by the generalized risk-on sentiment, positive data releases and investors’ repricing of a potential interest rate hike by the ECB at some point by year end.

In addition, yields of the key German 10y Bund advance to levels last seen in May 2019 past 0.03%, while yields of the US 10y benchmark navigate above 1.80%.

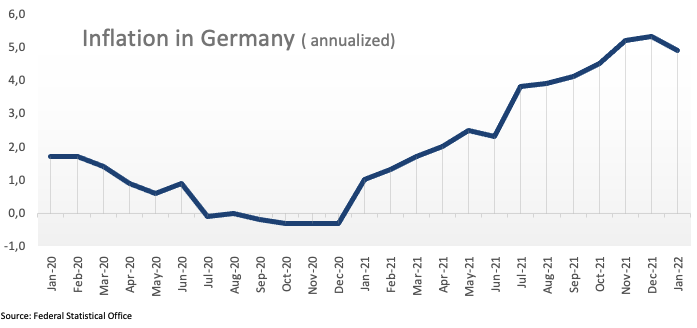

In the euro docket, advanced EMU Q4 GDP figures showed the economy is expected to have expanded 0.3% QoQ and 4.6% YoY. In Germany, preliminary inflation figures now see the CPI rising 0.4% MoM in December and 4.9% from a year earlier.

EUR/USD levels to watch

So far, spot is gaining 0.38% at 1.1190 and faces the next up barrier at 1.1198 (weekly high January 31) seconded by 1.1304 (55-day SMA) and finally 1.1369 (high Jan.20). On the other hand, a break below 1.1121 (2022 low Jan.28) would target 1.1100 (round level) en route to 1.1000 (psychological level).